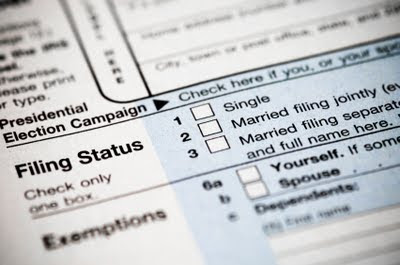

As millions of Americans file their income taxes today, activists will be staging protests to call attention to the tax inequities facing same-sex couples as a result of the state and federal laws that refuse to recognize or extend civil marriage protections to same-sex couples.These actions highlight the ongoing moral and financial costs of denying marriage equality to same-sex couples—as well as the consequences paid by all Americans as a result of these discriminatory state and federal laws.

Here are the facts from an email I received this morning:

Until we end the blatant and indefensible discrimination of DOMA we are not living up to the pledge we make to be a nation of liberty and justice for all, we are not providing the equal protection guaranteed by the 14th Amendment to same-sex couples and we are failing to defend the self-evident truth that our forbearers fought to protect: that ALL people are created equal.

Here are the facts from an email I received this morning:

“During tax season, same-sex couples are explicitly reminded that despite abiding by the requirements of American citizenship by paying taxes, they are still treated as second class citizens by the government, said GetEQUAL Director Robin McGehee.

“We are even taxed on our partner’s health insurance benefits, if they are even provided, which requires that required to pay more into social security taxes than our heterosexual counterparts knowing that when we die our families will not even have access to any of the family ‘safety net’ benefits provided in the form of social security survivor benefits, estate tax deferral, and other programs that we help fund through our tax dollars and that only heterosexual couples and their children will enjoy.”

A study produced by the Congressional Budget Office (CBO) debunks the myth that granting same-sex couples the freedom to marry would cost the government money. In fact, it would save taxpayer dollars. Same-sex couples aren’t the only ones paying for marriage discrimination, all taxpayers fund this discrimination which amounts to as much as $1 billion nationwide. To read the CBO study here.

3 comments:

We calculated that to cover my wife on my healthcare policy would cost us an extra $150 a month in taxes alone.

Interestingly, the IRS this year decided that RDP or married couples in Nevada and California MUST report their combined income on both returns, and although they cannot check "married", the IRS recognizes that they are. Convoluted reasoning.

And when the repeal of DADT is complete, legally married gay couples will have no marital benefits, thanks to DOMA. How do you look at someone risking his life for the country and tell him his marriage doesn't exist?

I'm so sick of this crap.

I was about to post a comment saying "Move to Canada". Equal access to marriage and nondiscrimination is the law here. But then I remembered my grief at not being able to celebrate my marriage in my church, and that my priest could be fired for giving us a blessing. Our government may be ahead of yours but the Anglican church is behind the Episcopal church.

And then there's the snow . . .

Patricia , good point. Our marriage was blessed in church in February, with the full knowledge and explicit approval of the Bishop. Odd when the Americans are ahead of the normally far more sensible Canadians!

Post a Comment